Why should Insurance Industry adopt New Techs

Technologies are evolving rapidly and the digital strategies of the insurance sectors must also adapt to these changes. New disruptive technologies have the power to completely transform the insurance industry and have the potential to be a catalyst for growth and transformation. Disruptive technologies are technologies that are both innovative and have the potential to revolutionise an industry. In this article, we will look at five disruptive technologies that have the potential to revolutionise the insurance industry.

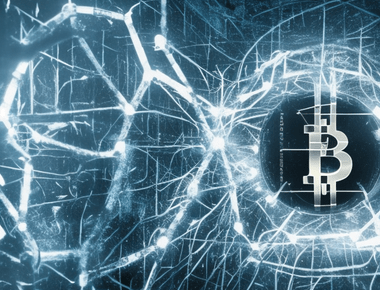

Blockchain

Blockchain is one of the most disruptive technologies in the insurance sector. The blockchain is a decentralised digital ledger that serves as a database recording all transactions and the information related to those transactions. The blockchain allows insurance companies to store information in a transparent and secure manner, making it easy for insurers to manage their policies and claims. Blockchain can also be used to create smart contracts that can automatically adapt to changing markets and conditions.

Smart contracts

Smart contracts are an application of blockchain technology that allows insurers to manage their contracts and claims more efficiently. Smart contracts are contracts that are programmed to automatically adapt to changing markets and conditions. Smart contracts can also be used to automate certain steps in the claims process, which can significantly reduce the time and costs associated with managing contracts and claims.

Artificial intelligence

Artificial intelligence is a technology that is revolutionising the insurance industry. Artificial intelligence enables insurance companies to better understand consumer behaviour and needs, allowing them to better target their products and services. Artificial intelligence can also be used to automate certain tasks to reduce costs and improve efficiency.

The Internet of Things

The Internet of Things (IoT) is a technology that is transforming the insurance world. The IoT allows insurance companies to better understand consumer habits and risks, enabling them to better target their products and services. The IoT can also be used to automate certain steps in the claims process to reduce costs and improve efficiency.

Robotics

Robotics is a technology that is revolutionising the insurance industry. Robotics allows insurance companies to automate certain tasks that are typically performed by humans, thereby significantly reducing the time and costs associated with these tasks. Robotics can also be used to automate certain steps in the claims process to reduce costs and improve efficiency.

Conclusion

Disruptive technologies are transforming the insurance industry. Technologies such as blockchain, smart contracts, artificial intelligence, the Internet of Things and robotics can all be used to improve the policy and claims management process to reduce costs and improve efficiency. Businesses that do not adapt to these technologies may find themselves in trouble and may even disappear. Therefore, it is important for insurance companies to understand and keep abreast of disruptive technologies to remain competitive and successful.

Quick Links

Legal Stuff